We all need financial literacy because it equips us with the knowledge and skills we need to manage money effectively. Scroll down to learn more!

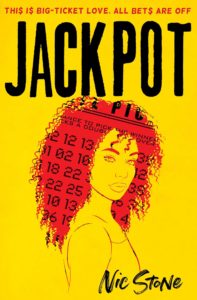

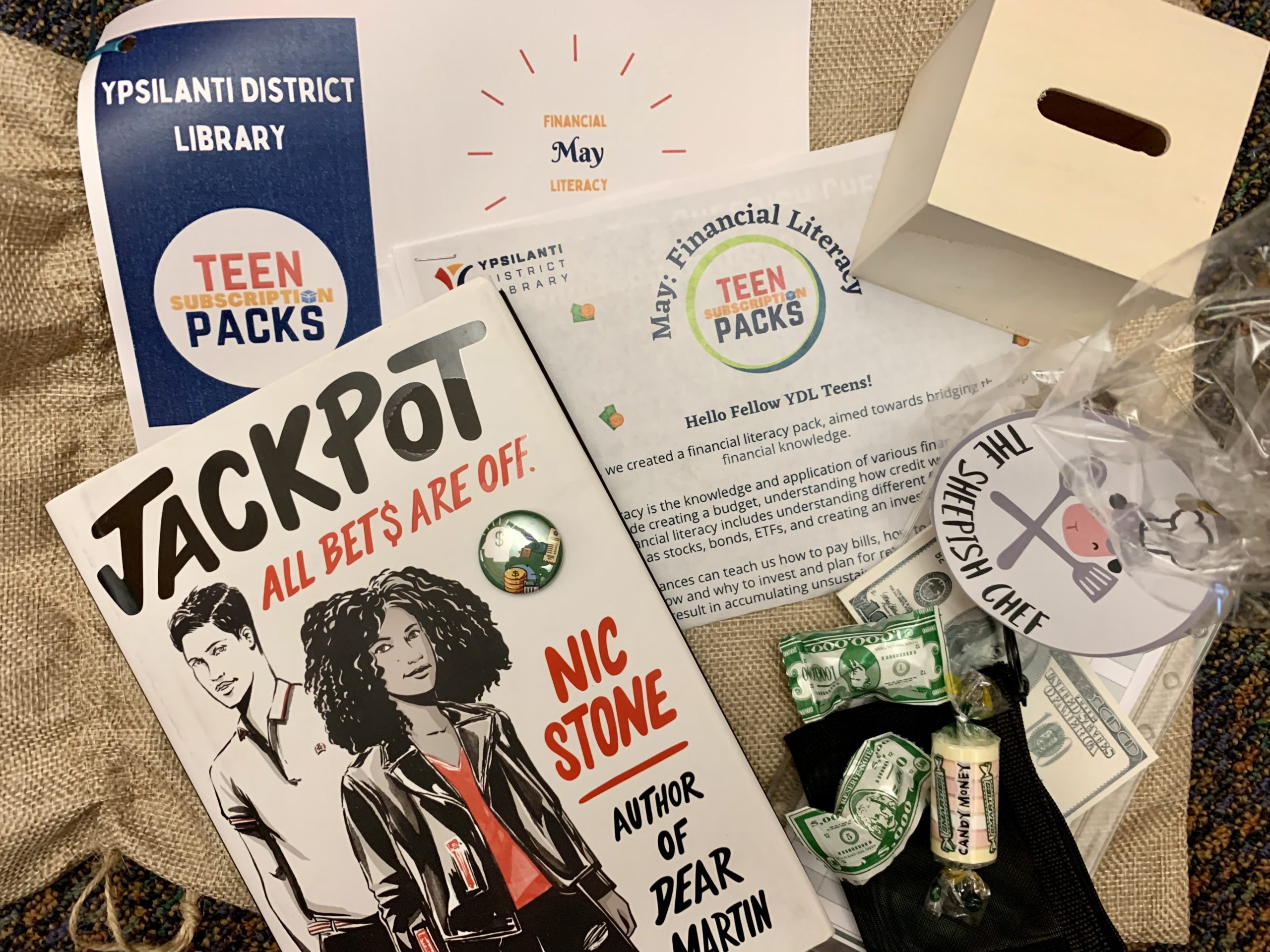

THIS MONTH’S BOOK

Jackpot by Nic Stone

Meet Rico: high school senior and afternoon-shift cashier at the Gas ‘n’ Go, who after school and work races home to take care of her younger brother. Every. Single. Day.

When Rico sells a jackpot-winning lotto ticket, she thinks maybe her luck will finally change, but only if she–with some assistance from her popular and wildly rich classmate Zan–can find the ticket holder who hasn’t claimed the prize.

But what happens when have and have-nots collide? Will this investigative duo unite…or divide?

SPOTLIGHT ON A LOCAL TEEN ENTREPRENEUR

If you picked up a pack this month, you got a treat from The Sheepish Chef, a local business owned by a teen named Liam Pemberton. Liam is a 16 year old sophomore at Huron who discovered a love of baking during the pandemic. He started selling dog treats, then expanded. His specialty is Millionaire Shortbread. After doing research for a class, he found that the ideal flavor is cinnamon with pumpkin spice latte topped with chocolate!

Visit his website to learn more!

TAG You're It Podcast

Read the Financial Literacy Pack Insert

AT HOME

WHAT IS FINANCIAL LITERACY?

Financial literacy is the knowledge and application of various financial skills like creating a budget, understanding how credit works, and saving for retirement. Financial literacy also includes understanding different financial instruments, such as stocks, bonds, ETFs, and creating an investment plan.

Learning about finances can teach us how to pay bills, how to borrow and save money responsibly, and how and why to invest and plan for retirement. Bad financial literacy can result in accumulating unsustainable debt burdens.

You can improve your financial literacy by subscribing to financial newsletters for free financial news, listening to financial podcasts, reading personal finance books, keeping a budget, saving, and investing. We all need financial literacy because it equips us with the knowledge and skills we need to manage money effectively.

Read on for tips!

TIPS FOR JOB HUNTERS

Think about the type of job you want and the positives and negatives that come with it, and the strengths and weaknesses you bring to it. What do you enjoy doing or hope to do in the future?

Make sure to show your knowledge and skills that will make you a good candidate for the job when you fill out the online application. Include all of your volunteer and extracurricular activities on your resume or the application to show your experience.

Be ready for an in-person interview and dress appropriately to put your best foot forward. Read up on common interview questions and think about how you could answer them beforehand. And learn about the business you’re applying to!

Follow up after the interview to say thank you and let them know you are still interested in working for them.

Getting a job before college looks good on your resume for future employers!

TIPS FOR CREATING A BUDGET

Look at your income and expenses, including taxes that are withheld and transportation to get to work.

Track your earnings and spending on a budget planner like the one linked below.

Develop a plan of action for spending vs. saving.

Budget for short and long term goals.

Adapt as you learn more!

SUCCESS AND MONEY MANIFESTATION PLAYLIST

TOP 3 FINANCIAL APPS

Mint Allows you to monitor spending, active loans, investments, and much more! You can even set budgets. This app is free!

Goodbudget Very easy layout and allows you to see how much you spend on gas, groceries, etc.

Fudget Fudget has a very simple layout with just gaining and spending money. It’s perfect for people who don’t want to focus on investments and just want to monitor their balances.

SAVING

Once you’re ready to save, click the button below on advice about setting up a savings account.

AT THE LIBRARY

Read a book to learn more! Click the image to find it in the catalog or on Hoopla.

We also have eResources to help you learn about investing your money, making informed decisions when you buy something big, and getting help choosing a career path or getting started on finding a new job!

Consumer Reports

Product reviews

ValueLine

Investment Education

Learning Express Library

Job and Career Guidance